Understanding Overhead, Margin, and Profit in Construction

What is Overhead?

Overhead is a big part of the cost of goods and services, and it impacts many pricing differences between competing companies. Your business might markup labor and materials by 30% whereas a competitor might markup 20% for the same item. However, if you both ended up with 10% profit, how could they charge less yet have the same profit? Assuming your labor and material costs are the same, the answer is overhead.

If you plan to stay in business for the long haul, you need to know your overhead and make sure you’re charging enough to cover it. Overhead percentages are different for every business and they change over time.

Overhead, put simply, is the cost of maintaining your business.

How to Calculate Your Overhead

If you don’t have any direct job expenses for a month (like subcontractors, materials, or production workers) your total expenses left would be overhead. Overhead is made up of things like rent, office employees, insurance, trucks, and tools.

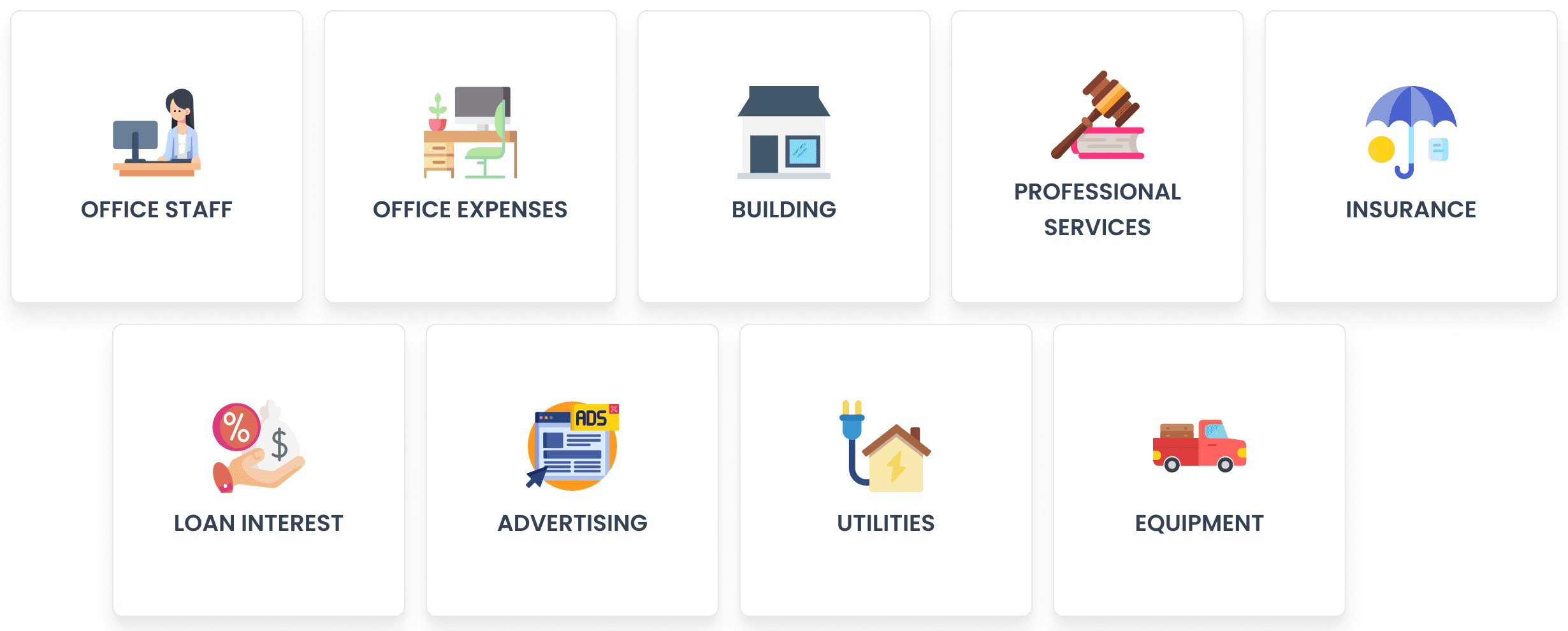

Common overhead items

Office staff: estimator, office manager, salesperson, and non-production employees

Office expenses: paper, electronics, breakroom supplies, meals, software

Building: rent/mortgage, upkeep

Professional services: accountant, lawyer, consultant

Insurance: general liability, automotive, base workman’s comp

Loan interest

Advertising: website, marketing, ads

Utilities: phone, internet, power, gas, sewer

Equipment: trucks, tools, heavy equipment, maintenance

Basic overhead calculation

A simplified approach to calculating your overhead would be to create a list of all of your overhead items for a year, then divide by 12. This would be your average monthly overhead expense. Averaging your overhead over time is important because some expenses like insurance usually aren’t billed every month. However, you also need to be aware of monthly changes or increases in your overhead over time so you’re aware of when your overhead is increasing.

Don’t forget to add the cost of your non-production labor as part of your overhead (potentially even yourself if you’re a business owner). Anything that isn’t a cost of production can be marked as overhead.

Your Overhead Percentage

Understanding how your overhead relates to your general business health can be a complex calculation that changes over time. When you're building an estimate, it's important to note how much of each job needs to be put towards overhead. Once you add up your total overhead, you need to understand your production output to figure out your overhead percentage.

What is production output?

Simply defined, production output is how much work you can complete and materials you can deliver in a certain period of time. If you have only one client and complete $25,000 of work in a month, your production output for that month was $25,000.

What if you bill by the hour? If you have 2 employees that are full-time (carpenters, technicians, etc.) working 160 hours each for a month, you have 320 hours each month of production work. If you billed $60 per hour for each worker, you have $19,200 of production output for that month.

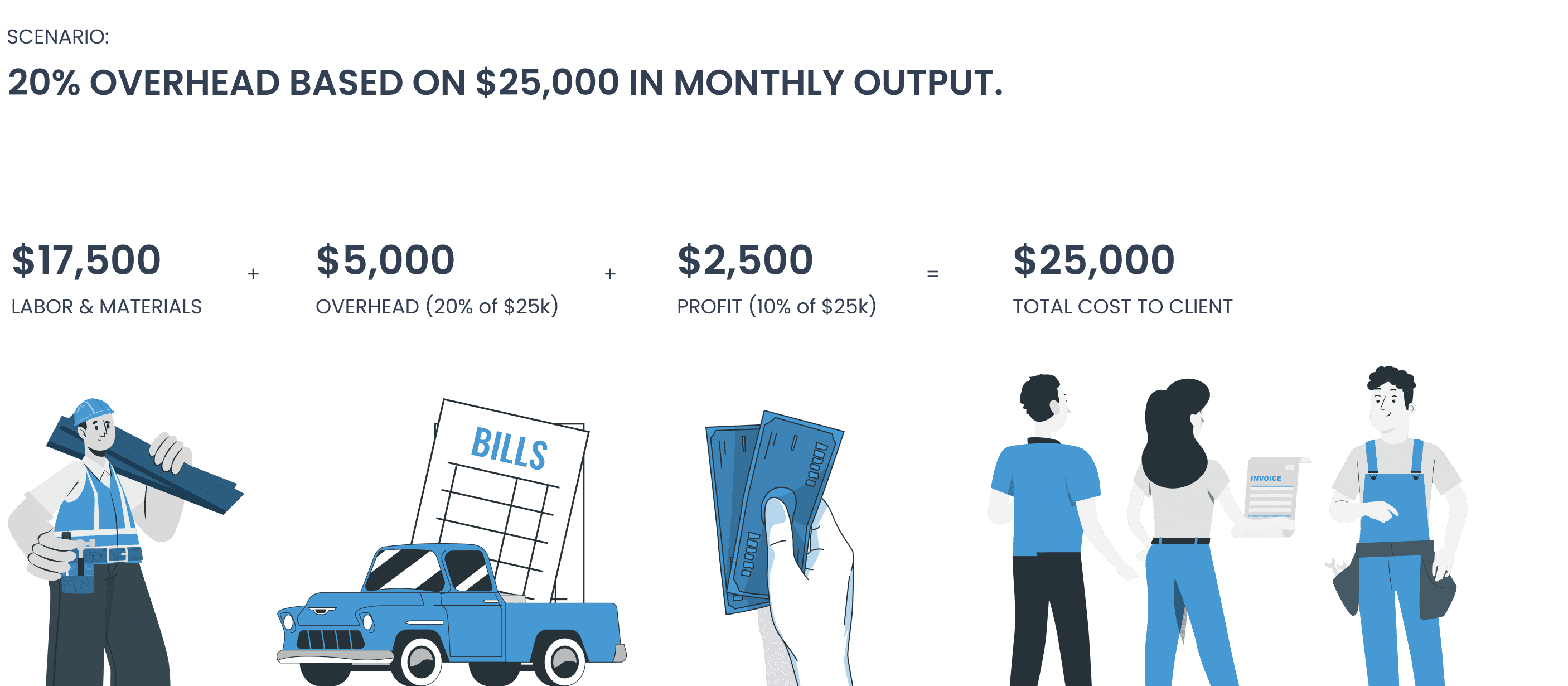

Figuring your margin

If your overhead is $5,000 each month and you complete $25,000 of work, your overhead is 20% of what you produced or your production output (5000 ÷ 25000). If you want to keep a profit of 10%, then your margin needs to be 30%. Margin is how much of your invoice is overhead and profit.

Remember, margin is not the same as markup! If you’re not a math expert, don’t fall in a trap by only adding 30% markup to your estimates. Your overhead and profit is higher as a percentage of your costs.

Figuring your markup accurately

Markup is how much you add to your material and labor costs to cover your overhead and profit. Remember our early example scenario of 20% overhead based on $25,000 in monthly output. This is what the breakdown would look like:

How to calculate markup from your costs

100% – 10% [Profit Percentage] – 20% [Margin Percentage]) = 70%

100 ÷ (100 – 10 – 20)

100 ÷ 70 = 1.42857

$17500 [cost] x 1.42857 = $25,000

Don’t confuse margin with markup!

If your margin is 30%, your markup is actually a little less than 43%. If from every dollar you earn, 20% is for overhead, and 10% is retained for profit, your total margin is 30%. That means you need to markup all your costs by about 43% (42.857% to be exact).

Does all this math sound way too complicated? ConGenius can help figure all this out automatically and make estimating extremely easy and accurate! Sign up for a free 14-day free trial. No credit card required!